Exploring Top Finance App Ideas

Technological advancements have transformed every industry. The application of technology in the financial and banking industry has improved the customer experience, increased the industry’s profitability, beefed up security, and enhanced financial transactions. The growth in the fintech sector is driven by crucial prevailing technologies such as big data analytics, blockchain, artificial intelligence (AI), and machine learning (ML). These developments have also accelerated the growth of fintech apps, with entrepreneurs and developers overflowing with stellar finance app ideas.

It is no secret that the COVID-19 pandemic rattled various industries worldwide. On the contrary, some industries benefited from the pandemic by witnessing dramatic growth and creating new business opportunities. Fintech is one such industry that is proliferating after COVID-19. According to research, the fintech industry is projected to reach USD 556.58 billion by 2030. The fintech sector is estimated to reach $1.5 trillion in annual revenue by 2030, constituting almost 25% of all banking valuations worldwide. Meanwhile, the fintech app market will reach $305 billion by 2025.

Without a doubt, finance apps are increasingly popular and are vital in spurring the growth of the fintech industry. If you’re an entrepreneur and/or app developer and want to invest in developing a finance app but are still deciding which finance app ideas to pick, read our article to clear your doubts.

Top Finance App Ideas

1. Digital Banking

Digital banking apps are booming; their usage is commonplace, and they are the epitome of finance app ideas. Consumers want to avoid the hassle of visiting bank branches or ATMs for money transfers or other banking services. To facilitate consumers, financial institutions use digital banking apps to provide seamless banking services. Users can benefit from a range of features that these banking apps offer, such as account management, fund transfers, bill payments, mobile deposits, ATM and bank branch locater, personal finance management, alerts and notifications, and customer support. Furthermore, the demand for mobile banking apps is increasing rapidly, especially after the COVID-19 pandemic. Experts believe the revenue for mobile banking will reach USD 1873.23 million by 2028.

2. Insuretech Apps

Like the fusion of finance and technology gave rise to ‘fintech,’ Similarly, the combination of insurance and technology created ‘insuretech.’ Insuretech apps are excellent tools for insurance businesses to expand their customer base. Insuretech apps provide user-friendly and advanced solutions for purchasing insurance policies, managing coverage, filing claims, and accessing customer support. Insuretech apps streamline insurance operations, offering convenience, enhancing customer experience, and helping users make informed decisions.

3. Loan Lending App

Lending apps, or P2P lending platforms, uphold the finance app ideas that facilitate borrowing and lending money between people without the assistance of any financial institution. These apps are intermediaries that connect borrowers and lenders who enter into loan agreements. A key advantage of lending apps is that they allow quick access to funds; investors can receive profitable returns.

4. Regtech

Regtech or regulatory technology is a fintech idea comprising apps to help financial businesses adhere to rules and regulations and comply with local and international standards. In a nutshell, these apps enable companies to manage their regulatory and compliance requirements more effectively. These apps use innovative technologies such as artificial intelligence, machine learning, and data analytics. Companies can automate their processes, such as identity verification for customer reporting, report compilation and submission, tracking transactions, and reporting. Significantly, regtech apps help to improve regulatory compliance efficiency, reduce the costs of manual processes, and enhance risk management.

5. Trading and Investment App

Trading and investment apps are mobile applications that allow individuals to buy, sell, and manage various financial assets directly from their smartphones or tablets. These apps provide users with a convenient way to access financial markets and participate in trading and investing activities. Users can make informed decisions about investing in forex, stocks, and funds. However, before making investments, it is advisable to exercise caution, do proper research, and seek advice from a financial advisor.

6. Digital Wallets

Another practical implementation of the finance app ideas is digital wallets, which offer an excellent replacement for physical wallets. They allow users to store, manage, and transact their financial payments virtually. Users can link their bank accounts, debit or credit cards with these wallets. Digital wallets commonly provide a variety of additional features, such as peer-to-peer transfers, mobile payments, loyalty program integration, and even support for cryptocurrencies. They offer convenience, speed, and better security, making them quite popular for online purchases, money transfers, and contactless payments.

Key Features of Finance Apps

Fintech projects, including apps, exhibit varied features and functionalities to assist users in making sound financial decisions. When your finance app ideas translate into reality, incorporate the key features commonly found in finance apps.

1. Budgeting and Expense Tracking

Fintech apps enable users to create budgets and track their expenses in real-time. Users can sort their costs, set spending limits, and receive alerts when they exceed their budget. They can also view comprehensive reports and visualizations to understand their spending patterns better and identify improvement areas.

2. Account Accumulation

Finance apps often allow users to connect and display the total value of their financial accounts, including bank accounts, credit cards, investment portfolios, and loans. This feature provides an overall view of their financial situation, making tracking and managing finances from a single platform easier.

3. Bill Payments

Finance apps often incorporate bill payment features, which enable users to pay their bills directly from the app. Users can set up automated payments and receive reminders for upcoming due dates, ensuring they never miss a payment and avoid late fees.

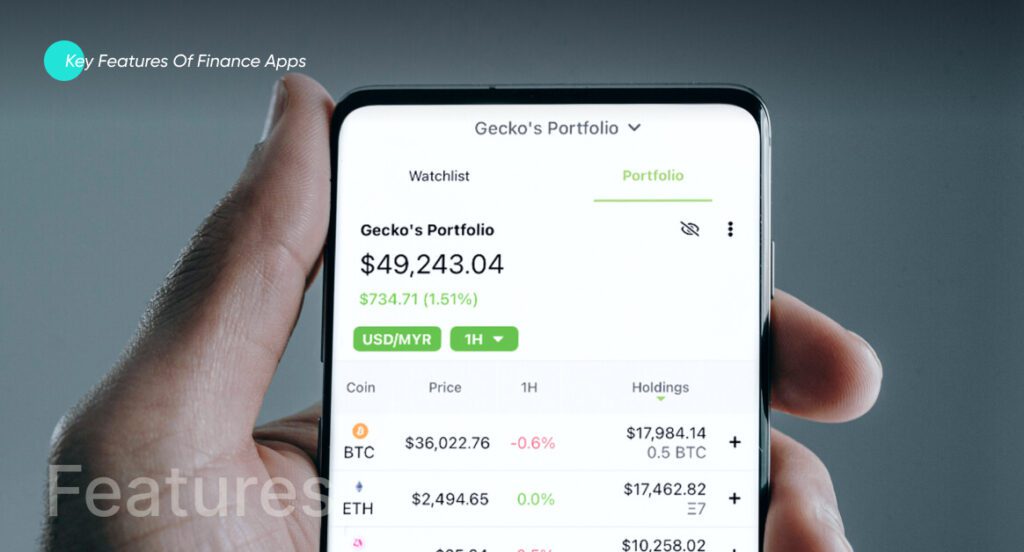

4. Investment Tracking and Portfolio Management

When you ponder your finance app ideas for creating an app, certainly include the investment tracking and portfolio management feature. Users can connect their investment accounts and monitor the performance of their investments in real-time. They can view their asset allocation, track individual stock and fund performance, and receive market news and analysis to make sound investment decisions.

5. Financial Goals

Many finance apps provide goal-setting and saving tools that are relevant to finances. Users can establish financial goals, such as saving for a vacation, accumulating funds for children’s higher education, or paying for a retirement house. The app helps track progress, suggests savings targets, and offers strategies to achieve those goals, such as setting up automatic transfers to a savings account.

6. Financial Insights and Analytics

When mulling finance app ideas, you should include data analytics to provide users with personalized financial insights. They analyze spending patterns, determine trends, and offer recommendations to improve economic well-being. These recommendations may include suggestions to reduce expenses, advance investments, or save more effectively.

7. Security and Privacy

Finance apps prioritize security and privacy to protect users’ sensitive financial information. These apps use encryption, secure connections, and two-factor authentication to safeguard data. Choosing apps from reputable sources and reviewing their privacy policies is vital before providing personal information.

8. Notifications and Alerts

Finance apps keep users informed about their financial activities through notifications and alerts. These alerts can include low-balance warnings, unusual transactions, bill reminders, and investment updates. Users can modify the notifications they receive and set their preferences.

9. Credit Score Monitoring

When evaluating your finance app ideas, include a credit score monitoring feature in your app, as it helps monitor credit scores and offers insights into factors that impact credit scores. Users can receive alerts when their score changes, access credit reports, and get tips for improving their creditworthiness.

10. Mobile Payments and Digital Wallets

Some finance apps offer mobile payment capabilities, allowing users to make secure transactions using their smartphones. They can link their bank accounts or credit cards to the app, make payments at participating merchants, or transfer money to other users within the app’s network.

Leading Fintech App Projects

Here are some of the leading finance app projects currently in the market, brainchild of pragmatic finance business ideas available. A study of these projects can assist you in choosing constructive and productive finance app ideas.

1. Robinhood

Robinhood is a commission-free stock trading app that has gained significant popularity. It authorizes users to buy and sell stocks, exchange-traded funds (ETFs), and cryptocurrencies. Robinhood also provides real-time market data and essential research tools.

2. PayPal

PayPal is a widely used digital wallet and payment platform. This app allows users to send and receive money globally, make online purchases, and link their bank accounts and credit cards for seamless transactions.

3. Coinbase

Coinbase is a cryptocurrency exchange tool that enables users to buy, sell, and store varied cryptocurrencies. It provides a user-friendly interface, real-time price charts, and a secure digital wallet for managing crypto assets.

4. Mint

Another top finance app idea that translated into reality is the Mint app. Mint is a popular personal finance app that helps users manage their budgets, track expenses, and monitor investments. It authorizes users to link their bank accounts and credit cards to get a complete view of their financial health.

5. Acorns

Acorns is an investment app that adds up users’ purchases to the nearest dollar and invests the spare change in diversified portfolios. It also offers automated recurring investments and retirement accounts.

6. Venmo

Venmo is a peer-to-peer payment app that allows users to send and receive money quickly. It also allows users to split bills and make payments at select merchants and has a social component that lets users see their friends’ transactions.

7. Credit Karma

Finance app ideas underpinning Credit Karma involve offering free credit scores, monitoring, and personalized financial recommendations. It helps users understand and manage their credit profiles and provides educational resources related to personal finance.

8. Wealthfront

Wealthfront is a robo-advisor app that provides automated investment services. It creates diversified portfolios based on users’ risk tolerance and investment goals. Wealthfront also offers features like tax-loss harvesting and direct indexing.

9. Betterment

Betterment is another popular robo-advisor that helps users invest their money in low-cost, diversified portfolios. It offers automated portfolio rebalancing and tax-efficient investment strategies.

10. Zelle

Zelle is a person-to-person payment app that lets users send money quickly and securely to friends and family in the United States. It is often integrated with major banking apps and allows instant transfers between participating banks.

What is the Cost of Fintech App Development?

If you have brilliant finance app ideas, evaluating the cost of a fintech app is crucial. The cost of fintech app project development depends on numerous factors. Typically, you must consider the app’s complexity, functionality, and development platform, followed by the development team’s rate and the region of their location. A basic finance app with standard features can range from $20,000 to $50,000. Meanwhile, finance with medium complexity can cost between $50,000 and $130,000. Finally, an advanced finance app with complex features can range between $130,000 to $500,000 or more. These are rough estimates, and the actual cost can differ based on various factors.

Let us Make You Finance App Idea into Reality. See Our Mobile App Development Services ![]()

FAQ

Fintech apps generate revenue through various means, including transaction fees, subscription fees, commissions, and partnerships.

Programming languages such as Python, Java, JavaScript, Ruby, and Swift are commonly used to develop finance apps.

You can secure a finance app by utilizing strong encryption for data in transit and implementing robust authentication and authorization mechanisms. Regular updates, app software patching, ensuring secure coding practices, API security, and complying with relevant regulations also secure an app.

Gohar is a seasoned IT writer specializing in leading technologies. He holds a Diploma and Bachelor's degree from the University of London, with professional experience spanning over five years in the IT sector. His expertise involves a keen focus on mobile applications, web apps, blockchain, content management systems, e-commerce, and fintech. Beyond the professional field, Gohar is an avid reader and reads extensively about emerging and innovative technologies.